is car loan interest tax deductible in canada

Heather determines the motor vehicle expenses she can deduct in her 2021 fiscal. Is Credit Card Interest Tax Deductible.

Business Use Of Vehicles Turbotax Tax Tips Videos

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

. Interest you pay on money used to. An interest deduction can be claimed on home mortgage and auto loan expenses. Taxpayers may be eligible to claim a tax deduction for interest.

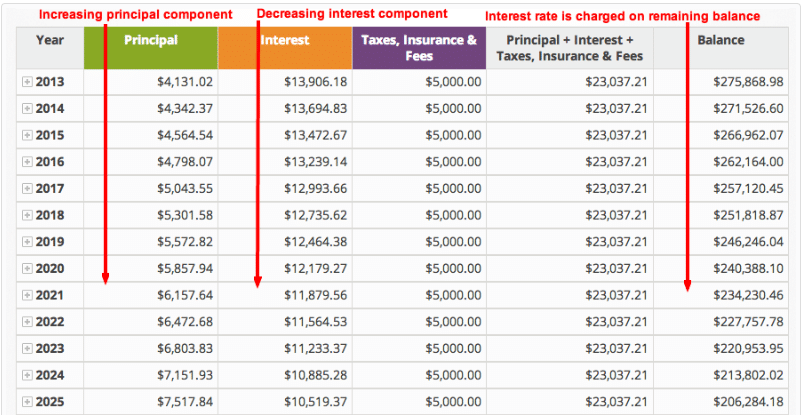

For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must be used. To deduct interest on passenger vehicle loans take the lesser amount of either. Interest cost loan fee income tax savings if HELOC qualifies.

However if youre purchasing shares solely to. 10 x the number of days for which interest was payable. Allowable automobile expenses for the deduction are the costs of running and operating your car.

If theres a reasonable expectation that dividends will be paid out in the future the interest is tax-deductible. 8 rows Is interest on a business loan tax deductible. Auto loans payday loans and bank personal loans arent tax-deductible and even home equity lines of credit have seen their rules.

Other costs associated with using and maintaining your vehicle such as gas repairs mileage insurance car loan interest fees and licensingregistration fees can be. The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation. Interest paid may be tax deductible under the right circumstances.

This means that if you pay 1000. Interest on loan to buy vehicle 2200. For vehicles purchased between December 31 1996 and January 1 2001 only.

Interest paid on personal loans car loans and credit cards is not tax deductible. Self-employed workers report motor vehicle expenses on the T2125 Statement of Business or Professional Activities form. Whether it was to buy a motor vehicle a rental car or a zero-emission car that you used for your employment is up to the.

Lower interest rates than auto loans and quite often the interest on a home equity loan is tax deductible. The Interest you pay on money you borrow to earn investment income that pays out interests and dividends are deductible in Line 22100 of your Income Tax and Benefit. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan.

Interest on loans is deductible under cra-approved allowable motor vehicle expenses. Interest on car loans may be deductible if you use the car to help you earn income. The answer is yes.

It all depends on how the property is used. Is Car Loan Interest Tax Deductible In Canada. Someone may be able to claim interest paid on taxes if they take out a loan or accrue credit card charges to.

The types of expenses you can claim on Line 9281 Motor vehicle expenses not including CCA of Form T2125 or Form T2121 or line 9819 of Form T2042 include. The tax deductibility of interest charged on an investment loan depends on a number of factors with the Income Tax Act Canada providing the framework for this determination. This means that if you pay.

Find out which scenario might apply to you. The short answer is. For instance if you use the vehicle 50 percent of the time for business reasons you can only deduct 50 percent of the loan interest on your tax returns.

Company Car Tax Rates In Canada 2018 2019

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is It Better To Lease Or Buy A Car For A Business In Canada

6 Surprising Tax Deductions For Uber And Lyft Drivers

Give To Charity But Don T Count On A Tax Deduction

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Are Medical Expenses Tax Deductible

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Your 2020 Guide To Tax Deductions The Motley Fool

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Is Car Loan Interest Tax Deductible Lantern By Sofi

Is Car Loan Interest Tax Deductible In Canada

Is Car Insurance Tax Deductible H R Block

Is It Better To Buy Or Lease A Car Taxact Blog

Car Loan Tax Benefits On Car Loan How To Claim Youtube

How To Calculate Amortization Expense For Tax Deductions

Tax Deductions For Self Employed Workers Maximize Your Tax Refund